Employer Resources Newsletter - July 2023

HR Best Practice: Auto-Enrolment in Pension Schemes

How Will Auto-Enrolment Affect Employers and Ireland's Retirement Future?

Earlier this year the government announced a significant step forward in addressing the issues faced by an aging population and the need for sustainable retirement solutions by implementing auto-enrolment pension schemes. The Bill cited as the Automatic Enrolment Retirement Savings System Bill 2022 is scheduled to go live early in 2024. The concept behind this is to ensure that more people have access to retirement savings and financial security in later years and represents a pivotal development for Ireland's retirement planning landscape.

However, with this fundamental change comes several implications for the employer and with soaring costs adds an additional financial burden on those in the nonprofit sector.

Understanding Auto-Enrolment?

Auto-enrolment is a policy mechanism that encourages employees to save for retirement by automatically enrolling them in a workplace pension scheme.

The primary objective is to overcome behavioural barriers that prevent individuals from saving adequately for their retirement. To combat employees’ reluctance to enrol in pension plans, possibly due to inertia or the fact that their employer does not provide its own pension plan, the Government has made it essential for all companies to contribute to a worker's pension, which will also be co-funded by the state.

The premise is simple: anyone between the ages of 23 and 60, and who is earning over €20,000 a year will be automatically enrolled, or opted into the pension scheme when they commence a new job unless they actively opt-out or have their own pension or access to an occupational pension.

An employee will have the option to opt-out or suspend contributions after six months, however, if still in Employment will be re-enrolled after two years. Once re-enrolled the employee will again have the option to opt out after six months, but clearly the objective is to get employees to remain enrolled.

Employer’s Current Pension Framework

Employers should seek professional advice and review any current pension scheme. Assessing whether employees should be encouraged to participate in an existing plan or whether auto-enrolment is a better solution for their organisation and employees in the future is a first step.

Existing schemes may need to be amended (which may require trustee approval) to ensure that appropriate rules for the auto-enrolment exemption apply once the system goes live. Any such changes must be considered and executed prior to the auto-enrolment System's implementation.

From the employee’s perspective, anyone that has already enrolled in an occupational pension scheme or equivalent personal pension scheme will not be automatically enrolled in the new system.

Operating Standards for Auto-Enrolment

Commercial pension providers will have the opportunity to participate in the auto-enrolment system through separate tenders for investment management, administration, and fund accounting services.

The Companies chosen to provide investment management services will be referred to as "Registered Providers." There shall be no direct interaction or relationship between the Registered Providers and the employees. Their sole customer will be the Central Processing Authority.

The Central Processing Authority (CPA), an independent organisation, will be established to monitor and operate the plan, as well as to set standards for the automatic enrolment retirement savings system on behalf of participating members and employers.

How does the Auto-Enrolment scheme affect employers?

Currently, Ireland is the only OECD country that does not use an automatic enrolment (AE) or comparable scheme to encourage pension savings. The proposed new approach is intended to simplify pension options for employees while also making it easier for employers to offer a workplace pension.

For those in the nonprofit sector it will be important to assess which of your employees will meet the eligibility criteria, as those who do not already have a pension scheme will be enrolled in the auto-enrolment pension.

You will need to ensure that your payroll can take instruction for enrolment and calculate and pay employee and employer contributions to the Central Processing Authority.

You will be required to match members’ contributions up to an eventual maximum of 6% subject to an earnings threshold of €80,000.

Employer contributions will be deductible for corporation tax purposes.

If you fail to meet your auto-enrolment obligations as an employer, you will be subject to penalties and possibly to prosecution.

How much it will cost the Employer?

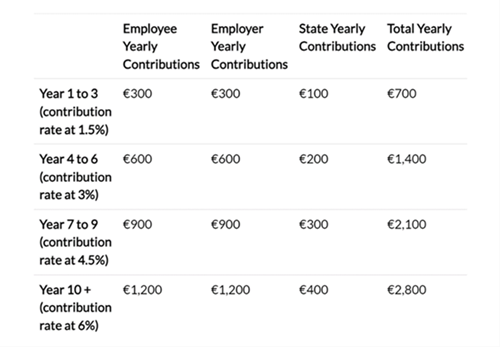

Employer contributions will start at 1.5% of gross pay.

- In year 4 they will increase to 3%.

- In year 7 they will increase to 4.5%.

- In year 10 they will increase to the maximum rate of 6%.

Contributions will be fixed, and employers will not be able to contribute less than the set rate.

As an illustrative example, for someone earning €20,000 per year, the actual amounts are:

Benefits for Employers

There are huge benefits for an employer with the introduction on auto-enrolment.

- Not having to pay to set up an organisational pension scheme.

- Not having to administer an organisational pension scheme.

- Ensuring that employees are looked after.

- Increased competitiveness and attractiveness as an employer.

- Employer contributions will be deductible for corporation tax purposes.

Updated recommendations to this Bill

Just last month the Joint Committee on Social Protection, Community and Rural Development and the Islands Committee with officials from the Department of Social Protection, The Pensions Authority, the ESRI, Irish Life, Insurance Ireland and employer and employee representative stakeholders held further talks on the pre-legislative scrutiny of the General Scheme of the Heads of Bill. They have put forward several recommendations, with the following points potentially most relevant to employers.

- Lower age limit to be reduced from 23 to 16 years, aligning it with the PRSI minimum age threshold.

- Lower income threshold of €20,000 be removed as the threshold of €20,000 can penalise young workers, low earners, and disproportionately women.

- When participants are auto enrolled, they should be given a sample of the likely pension they will receive on retirement in real terms by adjusting for inflation.

- That automatic-enrolment be covered by a strong governance framework, incorporating annual evidence-based reviews.

- Investment advice should be offered to all AE members to allow them to select the most appropriate fund for their age, gender, financial position, and circumstances.

- Clarity should be provided on the form of taxation to be applied to pension pots in retirement so that members can make proper provision for the future over the long term.

- The Department should carefully consider tax relief in the General Scheme of the Automatic Enrolment Bill and its impacts on the wider pension system.

This latest update for the Joint Committee implies that the Bill will need further modifications, however, the urgency to ensure that this is implemented in early 2024 is apparent. With less than 6 months to ensure you are prepared for these changes once introduced, it is important for employers in the nonprofit sector to familiarise themselves with the specific legal requirements and obligations outlined in the legislation.

WRC / Labour Court Decisions

Employee Awarded €31,000 for Compulsory Retirement

The complainant was awarded €31,558 as compensation for the financial loss arising from being unfairly dismissed.

Background

The complainant requested a period of leave from his organisation, arising from Public Health advice based on his age. He stated that he advised his employer that he wished to return to work after being on leave for several months. However, this request gave rise to a series of interactions with the Director that ultimately led to his dismissal on the ground of his age. At the date of dismissal on the 3rd of July 2020 the complainant was 68 years of age. The complainant maintained that there was no organisational policy relating to compulsory retirement. The organisation stated that there was an organisational retirement age based on the eligibility for the contributory state pension which at the date of termination was 66. At the organisation’s sole discretion and based on individual suitability and organisational needs, an employee may continue to work after the age of 66, subject to review.

Summary of Complainant’s Case

The employee had an expectation that he could work like any other employee; subject to his physical and mental capacity to do so. The custom and practice at the organisation was not to impose a mandatory retirement age. The organisation did issue a contract around 2015 for the first time, detailing a retirement age linked to the age eligibility for a state pension; however, he never signed that contract. A contract cannot be changed unilaterally. In any case as was the custom and practice he had continued to work past the state pension eligibility of 66. A colleague of his had worked into his 72nd year. The Complainant was dismissed because of his age and not because the employer exercised an agreed retirement term of the employment contract. Since being dismissed he had applied for several positions as without success.

Summary of Respondent’s Case

The organisation denied it discriminated on the ground of age. The organisation had a clear retirement policy. During normal times it facilitated a retirement process that was flexible. The change in the policy arose because of the pandemic. The policy allowing an employee to work past 66 years of age was on an individual basis. The organisation invoked the retirement age term stated in the employment contract due to the public health guidelines that indicated older people such as the complainant were more vulnerable to the virus. To protect him, the organisation asserted its right to retire the employee.

Findings and Conclusions

The Unfair Dismissal Act 1977 as amended provides for an exclusion for an employee who is dismissed and who, on or before the date of his dismissal, had reached the normal retiring age for employees of the same employer in similar employment. It also provides that the dismissal of an employee shall be deemed, for the purposes of the Act, to be an unfair dismissal if it results wholly or mainly from certain factors, one being the age of the employee.

In this case the complainant stated that the custom and practice regarding a retirement age at the organisation was flexible based on individual preferences and most definitely was not mandatory.

The organisation stated that it facilitated employees to transition into retirement. This meant an employee could retire at 66 or later. However, the policy was to link the organisation’s retirement age to the eligibility for the state old age contributory pension which is now 66. The organisation stated it had clarified its policy in new contracts issued to staff in 2015.

There is no signed contract on behalf of the complainant.

The organisation in evidence stated that up to the pandemic it had a flexible approach to the retirement age. However, based on public health guidelines it wanted to protect vulnerable employees and on the 19th of June 2020 wrote to the complainant and stated:

“…unfortunately given the national developments and health pandemic over the last number of months I have had to reconsider this, and I am now making it an official organisational policy that retirement be taken in line with the state pension.”

This evidence is clearly supportive of the complainant’s position that the employer unilaterally changed his terms.

The Adjudicator noted the fact that no public health guidelines exist that require an employer to retire employees over the age of 66 because they were more vulnerable to younger employees. The manager who made the unilateral decision to change the retirement policy because the complainant was of a certain age and was allegedly more vulnerable; was noted as not medically qualified to make that decision. It may have been reasonable if the decision was based on independent medical advice, but it wasn’t. The fact is many employees in this age category continued to work during the pandemic and took the necessary precautions to minimise harm to themselves. There is no evidence to suggest that the complainant was unfit to work. The practice in the respondent organisation on the evidence of both the employee and the manager was to facilitate employees to continue to work past a notional age for retirement and one employee had in fact worked until his 72nd year.

The fact is that there was no mandatory retirement age at this organisation up until the 19th of June 2020 and that is clearly affirmed in the letter to the complainant (dated the 19th of June 2020) when the manager stated that: ‘and I am now making it an official organisation policy that retirement be taken in line with the state pension’.

On the evidence provided, the manager is making a unilateral change without the right to do so. The reason being that the employee is vulnerable and therefore should retire. The Adjudicator noted that this is not reasonable, as the manager’s decision distorts public health guidelines to justify his decision.

The employee has made extensive efforts to mitigate his loss and it is evident that the conduct of the employer has caused very significant financial loss.

The Adjudicator noted that the employee did not appeal the decision to the organisation, stating that he believed that there was no point as the policy change was so absolute.

The Adjudicator determined that the employee was unfairly dismissed based on the ground of age where there was no normal retirement age and in circumstances where the vulnerability of the complainant was being assessed by the manager who was not medically qualified to do so.

The complainant was dismissed due to no fault on his part. However, as time had moved on it was not viewed as practical to reinstate him and having regard to his request for compensation; the Adjudicator therefore determined that this is the correct form of redress in this case.

The Adjudicator noted that it was highly unlikely that the complainant will be re-employed. The complainant was dismissed in his 68th year. It is highly probable that he would have worked until his 70th birthday. In these circumstances his actual loss was determined to be 78 weeks or 18 months. His gross annual salary at the time of dismissal was €21,039 x 1.5= €31,558.

Decision

The complainant was awarded €31,558 as compensation for the financial loss arising from being unfairly dismissed.

The Adjudicator noted the second complaint brought by the complainant under the Equality Act, and outlined that this is in essence, the same claim that has been determined under the Unfair Dismissals Act as it states that the treatment complained of is compulsory retirement based on age.

The Adjudicator determined that as compensation has already been awarded under the Unfair Dismissal Act, a further award under the Equality Act would amount to double compensation based on the same facts and therefore determined that this complaint, because it amounts to a parallel claim, is not well founded.

Our Commentary

This case reminds employers to proceed with caution when dealing with the area of retirement. There was no mandatory retirement age in the respondent organisation over the years and their retirement policy was changed in 2020 during the pandemic, to a compulsory retirement age of 66. The rationale given for the change was public health guidelines and that employees over the age of 66 were more vulnerable than younger employees. The Adjudicator found that the respondent’s manager made a unilateral decision to change the retirement policy without the right to do so, and also that he was not medically qualified to make the decision that the complainant was vulnerable and therefore should retire. This approach may have been reasonable if the decision was based on independent medical advice, but it wasn’t and there was no evidence to suggest that the complainant was unfit to work. The Adjudicator noted that the manager’s decision distorted public health guidelines to justify the approach taken.

Did You Know?

Enactment of Certain Provisions of the Work Life Balance Miscellaneous Provisions Act

From 3 July 2023, two provisions from the Work Life Balance Act, 2023 came into effect.

Leave for medical care purposes

The Act introduces up to five days’ unpaid leave, in any 12 consecutive months, per employee, where, for serious medical reasons, the employee is required to provide personal care or support to:

- A child under the age of 12 or, if the child is adopted, between the ages of 10 and 12 within two years of the adoption, or under the age of 16 if the child has a disability.

- A spouse/civil partner, cohabitant, parent, grandparent, sibling or someone who resides in the same household as the employee.

Medical care leave requirements shall be confirmed on a prescribed form submitted by the employee to their employer and leave cannot be taken in periods of less than one day. The employer may request relevant evidence from the employee of their relationship with the person needing medical care, the nature of the medical care required and medical certification of the serious medical issue.

This leave is only applicable for days on which the employee would have typically been due to work. This leave is in addition to existing entitlements under the Carer’s Leave Act 2001 and force majeure leave.

Call to Action

Organisations in the nonprofit sector must now develop a policy for the new statutory leave ensuring the details of which are communicated to all staff. In order to best prepare for applications for this type of leave employers should prepare an application form and confirmation letter for the medical care leave.

Extension of Breastfeeding Entitlements

With the introduction of the Work Life Balance Act there is now an amendment to the definition of an “employee who is breastfeeding” under the Maternity Protection Act 1994.

The Act introduces an extension of the period during which employees have an entitlement to paid time off from work or a reduction of working hours for breastfeeding purposes which has increased from 26 weeks to 104 weeks from the date of birth of a child.

Employers must ensure that the appropriate updates are made to their maternity leave policy to ensure compliance with the new legislation.

What’s Next?

Employers should familiarise themselves with these new obligations and entitlements in order to make the necessary amendments and administration arrangements internally to manage the employee leave.

If your Organisation requires support, advice or guidance on developing and implementing policies and procedures, employee relations support or details of the supports provided under our Partnership Programme contact our expert-led team at Adare Human Resource Management.

Dublin Office: (01) 561 3594 | Cork Office: (021) 486 1420 | Shannon Office: (061) 363 805

info@adarehrm.ie | www.adarehrm.ie